Triple-Net Lease (NNN)

Hands-off. Low risk. Steady Income.

NNN properties are the easy-button of commercial real estate investment. Want in?

Triple Net Lease (NNN)

What is a Triple Net Lease (NNN) investment?

For many, real estate investment is at its best when its hands-off, low risk, and produces a steady income.

For investors who think this way, they’re not interested in the day-to-day work of property management. These are often people with a career’s worth of capital and experience. They’ve done the difficult task of growing their business or portfolio.

They want to relax, freeing themselves of the responsibility to make improvements, oversee repairs, and pay monthly bills:

- Entrepreneurs ready to divest themselves of their business

- Real estate investors looking to sell the property they actively manage

- Anyone who wants to invest in a safe, high-yield, no-hassle commercial real estate property

- Individual looking to pass on their stable investments, wealth, and income to subsequent generations

Investors like these may be ready for a triple net (NNN) investment property. These are properties where the tenant is responsible for real estate taxes, insurance, and maintenance (the 3 “nets” of real estate).

For NNN leases, when something goes wrong, the tenant has the cash, motivation, and core-competencies to take care of the problem. Landlords don’t have to worry about roof repairs, leaky faucets, remodeling jobs, or insurance claims.

And, NNN tenants can handle all the accounting themselves. They pay on time and take care of everything. Does that sound like the opportunity for you?

If so, Hilliker brokers — in collaboration with our sister company, Westwood Net Lease Advisors — expertly guide investors into triple net investments. And a carefully chosen NNN property can provide you (and your heirs) with income for years to come.

What is a Triple Net Lease (NNN)?

A triple net lease (NNN) is one in which the tenant usually handles three categories of expenses:

A triple net lease (NNN) is one in which the tenant usually handles three categories of expenses:

- Insurance

- Build-out and repairs

- Taxes

NNN tenants are typically highly creditworthy national chains. They include (though aren’t limited to):

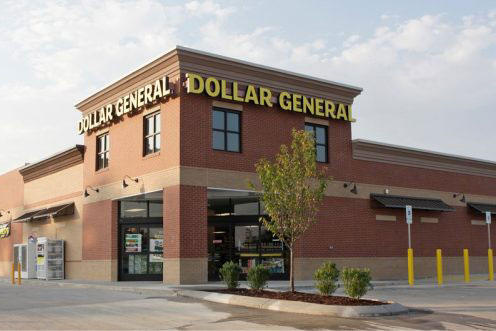

- Retail chains like Dollar General, 7-11 and Walgreens

- Restaurant chains like Buffalo Wild Wings, Applebee’s, and KFC

- Auto maintenance chains like Good Year, AutoZone, and O’Reilly Auto Parts

- Institutions such as Chase Bank or Goodwill

- Medical facilities such as Fresenious Dialysis, NextCare Urgent Care, or Surgery Partners

For NNN tenants, the business itself is their primary focus. They don’t want to own the property itself. But since NNN tenants are usually businesses that see customers day in and day out, they’re highly motivated to keep the building beautiful and functional.

For those interested — and well-positioned — for a triple net investment, here’s how we proceed.

Roll Your Current Investments through a 1031 Exchange

A 1031 Exchange is a tax deferment tool. It allows investors to use all the proceeds from the sale of one investment property for a “like-kind” exchange — another property held for a business or investment purpose. It has to meet specific requirements, and you can read more about 1031 Exchanges here.

First, Hilliker Corporation brokers can help you list and sell your current investment. With experience that dates back to our founding in 1985, we’ve completed over 10,000 transactions. Your Hilliker broker will help you:

- List and market your current property

- Find a buyer

- Effectively negotiate its sale

Simultaneously, in conjunction with Westwood Net Lease Advisors, we can help you gather the team you’ll need to set up a 1031 Exchange successfully:

- Accountant

- Lawyer

- Lender

- Contractors

- Title company or other “qualified intermediary”

- Any other professionals needed for your specific situation and goals

Then, your broker can become the hub around which all the action takes place. When you work with us, you’ll know what you need to do, who you need to speak to, and where you need to be.

With Hilliker Corporation, you’ll get the deal done with as little friction as possible.

Find and Negotiate Your Triplet Net Property (NNN) Purchase

First, your Hilliker broker can help you sell your current commercial property or properties.

First, your Hilliker broker can help you sell your current commercial property or properties.

Then, we collaborate with Westwood Net Lease Advisors to identify lucrative opportunities for a triple net investment. Together, we will assess:

- Your goals

- Your budget

- Your risk tolerance

From there, we’ll provide you with our pipeline of potential properties and tenants. You’ll have the tools and experts at your disposal as you evaluate:

- Tenant creditworthiness

- Lease terms

- Properties

- Locations

- Capitalization (cap) rates

Once you own the property, there’s little left for you to do! Since your tenant is a company that takes care of almost everything, you don’t have to manage it actively. You just collect the rent checks.

It really is the easy-button of real estate investing.

Your Real Estate Life Cycle Options: Divest, Diversify, or Upgrade

Our triple net investors are usually in one of two phases of their Real Estate Lifecycle.

Our triple net investors are usually in one of two phases of their Real Estate Lifecycle.

Those in the Growth and Maturity Phase may desire greater portfolio diversity. Those in the Exit Phase may seek reliable income without the stress of property management.

Whatever your situation, you can continue to leverage your property well into the future.

Divest

If you decide it’s time to pull out of your commercial real estate holdings altogether, we can match your current properties to new buyers.

Diversify

As the value of your investment grows, and your purchase power increases, expand your NNN portfolio into different industries or locations.

Upgrade

As mentioned earlier, 1031 Exchanges allow for tax-free reinvestment indefinitely. Grow your income, your freedom, and the benefit to your heirs. Wherever you are in your Real Estate Lifecycle, we have options tailored to your situation and geared for your success. If you’re ready to make your next move, contact a Hilliker broker today.

How Hilliker Helps St. Louis with NNN Properties

The Minifig Shop goes from online store to brick and mortar retail

Building a Small Business Brick by Brick Mike Atwood is skilled at building things. When he was a kid, he’d work up to 70 hours a week in his dad’s engine repair shop. As an adult, his building skills shine through a different medium — a successful full-time career as...

Dave Spence sells pharma HQ for $12.2M

The North County headquarters of Legacy Pharmaceutical Packaging has been sold for $12.2 million. The buyer was New York-based Royal Oaks Realty Trust, which owns more than 3.6 million square feet of property across 13 states. The sale, which closed Aug. 14, includes...

Divest for Success — Here’s When to Sell Your Commercial Real Estate Investment

Over my thirty-three years in the commercial real estate business, I’ve helped hundreds make smart property investments. The market is complicated, but with an average rate of return of 10.6%, real estate consistently outperforms the S&P 500 Index (roughly 8%)....

How Hilliker Thrives in the Cutthroat Commercial Real Estate World

The independent, Brentwood-based firm credits a hyperlocal approach with national connections for its success in face of its heavy-hitter competitors. When Ben Hilliker started his real estate firm more than 30 years ago, he could count his competitors on one hand....

Better Deals, Less Stress: How to Choose the Right Commercial Real Estate Broker for You

I was in my early-30s when I got started in Commercial Real Estate. That was over thirty years ago! Then, as now, newer Brokers teamed up with more experienced Brokers to learn the ropes. That’s when I met Wallace McNeill. Wallace was the first person to show me how...

Do You Know What You’re Signing? Here’s How to Understand Your Commercial Real Estate Lease Agreement

Here’s a familiar story. An entrepreneur is outgrowing her current space or is ready to lease new space for the first time. She goes for a drive, sees a sign on a building that looks like it might fit her company’s needs, and calls the number listed. She asks the...

The Future of Retail Properties – KMOX Interview

KMOX 1120 Anchor & Reporter, Michael Calhoun interviews Sentinel Emergency Solutions and Hilliker Broker Associate about their unique development and the future of retail properties.

How to find Commercial Property in St. Louis

Looking to Rent or Buy Commercial Property in St. Louis? Here’s How to Start your Search Over the next several months, members of our team of Commercial Real Estate Pros will be sharing their expertise with people like you — business leaders poised to move to a new...